Healthcare

Reimagined

The first group captive built to bend the healthcare cost curve.

Join the only group medical stop loss captive designed to return surplus quickly, reduce claims, and protect shared risk.

What is a Captive?

Stop paying for everyone else's claims.

A group medical stop loss captive is a self-funded model where employers share risk to protect against high-cost claims. This approach delivers more predictable renewals, shared cost-containment strategies, and potential surplus returns-giving employers greater financial stability and flexibility.

Flexibility

From plan design to risk tolerance and vendor partners, you choose what matters most.

Surplus Returns

Keep what you don't use. Lower claims mean surplus funds stay with your group-not the insurer.

Predictability

Group captives offer transparent pricing and more predictable renewal costs.

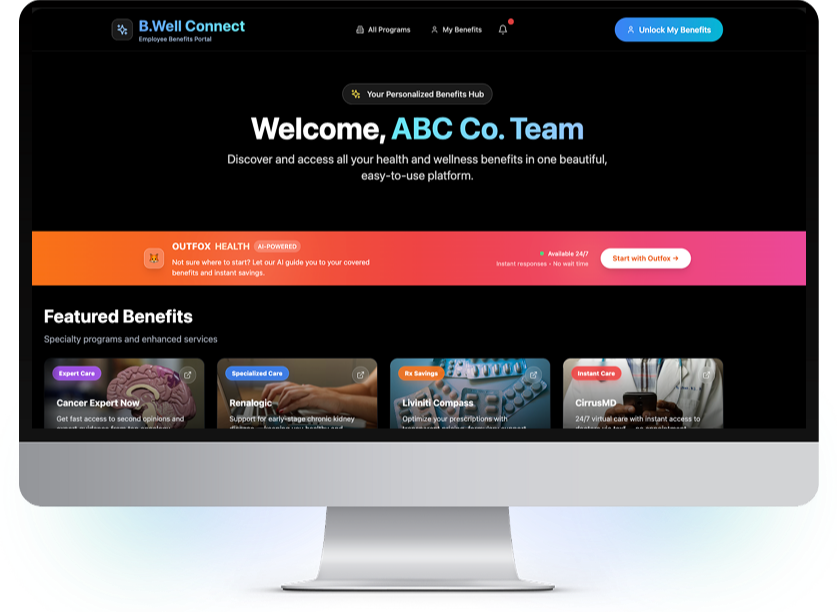

The Engine Behind Every Blackwell Solution

B.Well equips every Blackwell group with AI-powered guidance, data-driven insights, and proven tools that prevent large claims-before they happen.

AI Provider Search

Custom co-pilots guide employees to high-value, low-cost care based on your plan.

Boost Engagement

Employees get real-time support navigating care, conditions, and costs.

Total Plan Visibility

Track spend and influence outcomes before claims spiral out of control.

Cost Containment

Cost containment is included and configurable-no added PEPMs or vendor contracts.

Better Care Through Better Partners

Proven care strategies that drive real cost savings at the best price.

of Self-Funded Groups Will Trigger a Stop-Loss Claim This Year

of Self-Funded Employer Groups Will Face a $1M+ Stop Loss Claim

The Blackwell Difference

At Blackwell Captive, we offer more than just stop‐loss insurance — we deliver a smarter, shared risk model built to lower your costs, improve predictability, and keep surplus dollars where they belong: in your organization.

B.Well helps prevent large claims before they happen with embedded tools and targeted interventions-no extra pepms required.

- Built-In, Not Bolt-On

- Protects the Captive Layer

- Targets First-Dollar and High-Cost Claims

When claims are lower than expected, unused funds stay with the group—reducing future costs instead of boosting an insurer’s bottom line.

- Spread the Risk

- Keep What You Don't Use

- Reinvest in Future Savings

Our embedded AI tools help employees navigate healthcare intelligently—from finding quality providers to managing chronic conditions—resulting in better outcomes and lower costs.

- One Hub for All Health Benefits

- Drives Point Solution Engagement

- Actionable Insights for Employers & Brokers